Remember Robin Ramirez, the mastermind behind a $40 million coupon fraud scheme that duped major brands like Procter & Gamble and Unilever? Her clever scam, which involved selling fake coupons online, seemed like a victimless crime until she was caught and sentenced to 12 years in prison. But the truth is, fraud is never victimless. It costs businesses billions annually and can damage their reputation and customer trust.

People often justify fraudulent behavior by thinking they’re just one person taking advantage of a loophole, and it won’t hurt the brand.

Lisa Washington

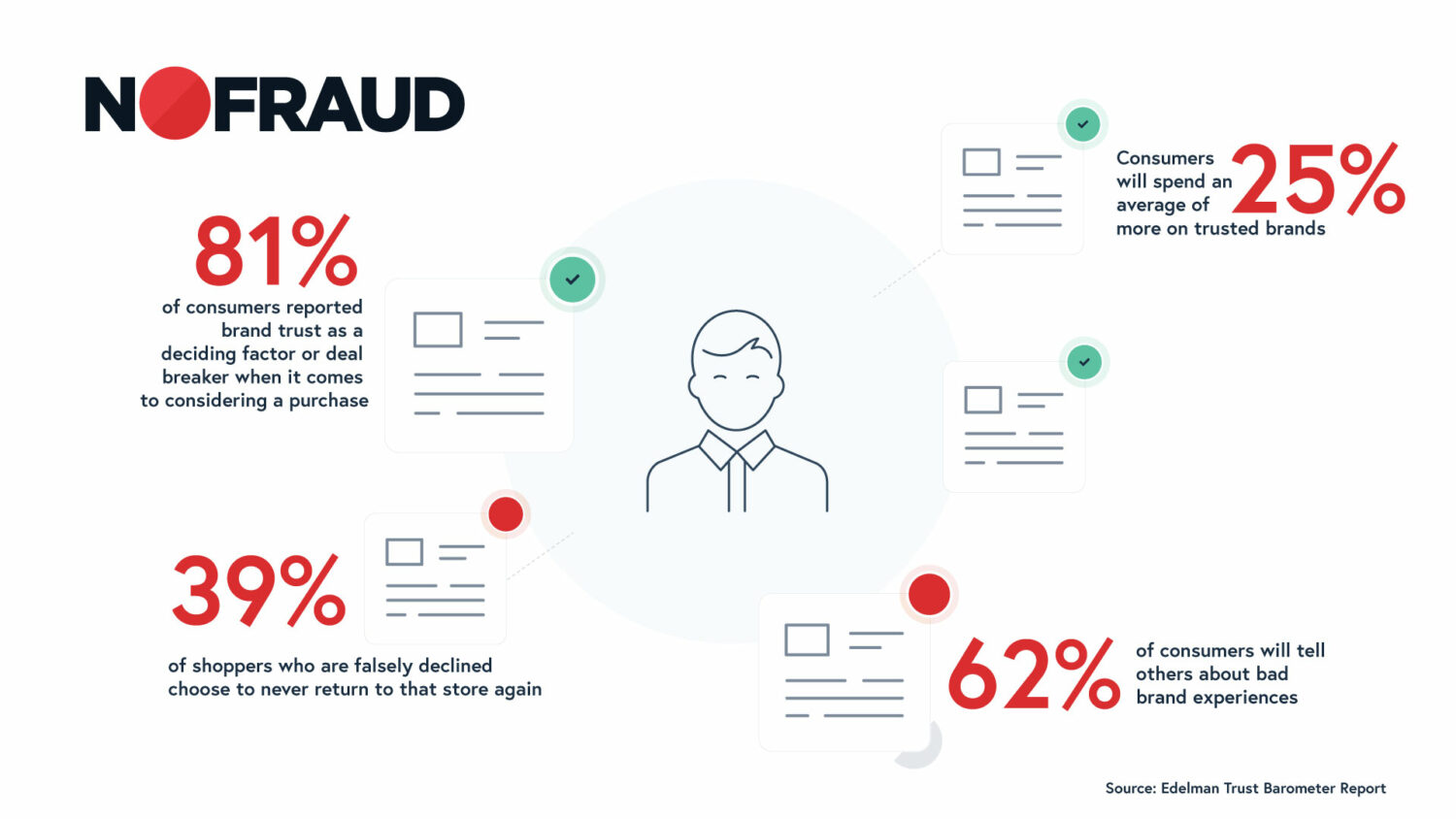

Lisa Washington, a fraud prevention expert and Customer Success Manager at NoFraud — who has worked with 500+ merchants — has witnessed the devastating impact of fraud on eCommerce businesses. “People often justify fraudulent behavior by thinking they’re just one person taking advantage of a loophole, and it won’t hurt the brand; they have plenty of money to spare,” Lisa notes. “But the reality is that fraud is a vicious cycle that can quickly spiral out of control. It’s like a domino effect, where one fraudulent transaction leads to another, and before you know it, you’re dealing with a full-blown fraud attack that can bring your business to its knees. And it’s not just the devastating financial losses — it’s also the damage to your reputation.” When fraudsters target your business, they’re not just stealing from you; they’re also undermining the trust and loyalty of your customers. And once that trust is broken, it’s tough to regain.

In this blog post, we’ll delve into the latest insights from Lisa as she shares:

- The hidden costs of fraud on loyal customers

- Eight fraud trends she’s noticing this year

- Proactive fraud prevention strategies to fortify your business against current and emerging threats

- How pre-gateway prevention and AI-powered detection are game-changers