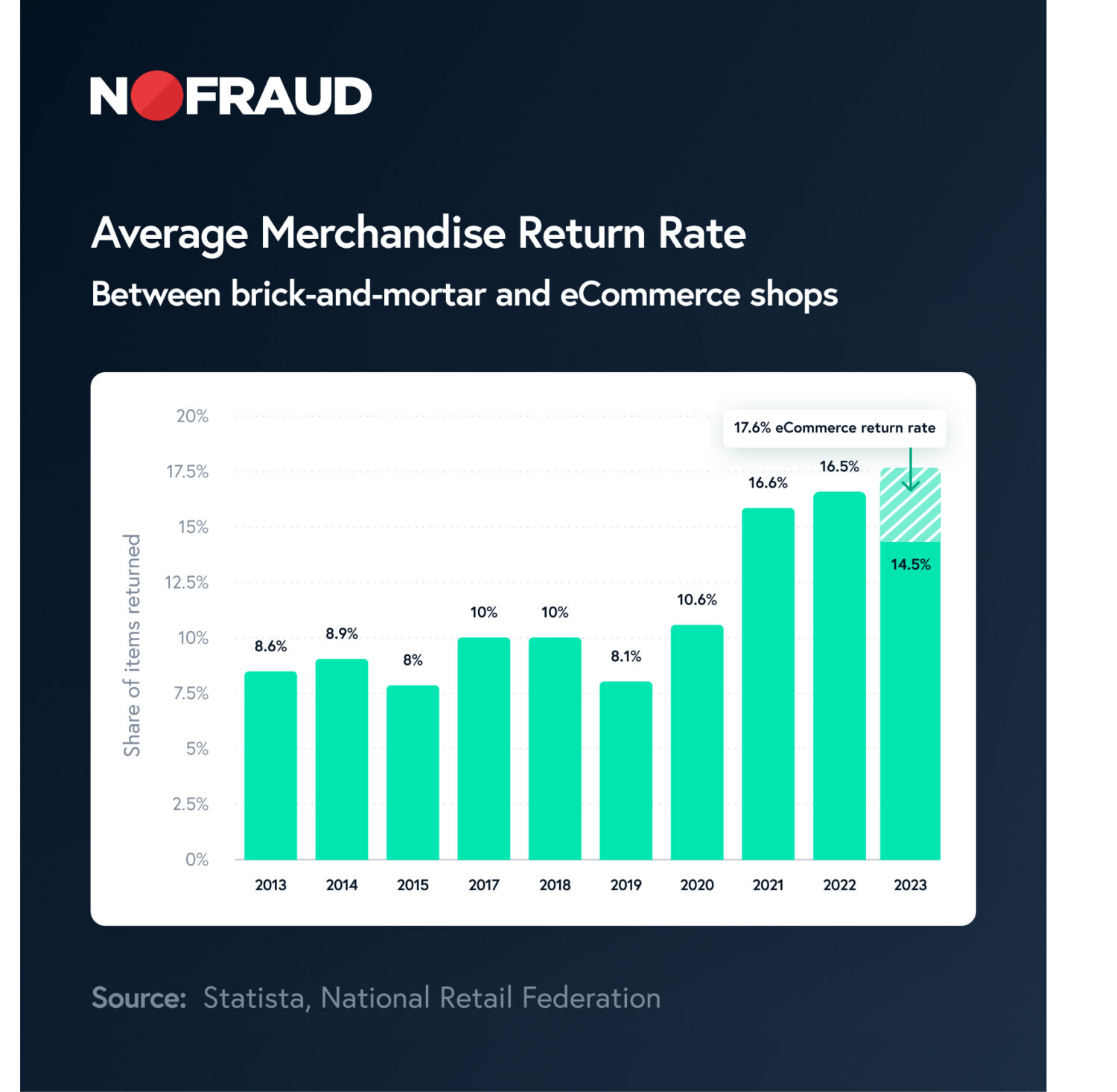

Return fraud causes significant financial losses for retailers and can lead to higher prices for consumers to offset these losses. A growing concern, here’s how return fraud affects eCommerce businesses.

Financial Loss

Merchants incur an average of $145 million in merchandise returns for every $1 billion in sales, and for every $100 in returned merchandise, retailers lose $13.70 to return fraud. The loss adds up with indirect costs, like shipping and handling, restocking, and the loss of merchandise value, especially in cases where returned items can no longer be sold as new. Even worse, when return fraud involves false claims of item not received (INR) or did not arrive, merchants lose out on both merchandise and revenue, costing them double.

Operational Strain

Handling fraudulent returns puts a strain on a company’s operations. Resources are diverted to deal with the returns process, which can be complex and time-consuming, especially in cases where fraud is suspected or a chargeback has been initiated. This includes additional customer service time, inspection of returned goods, and compiling transaction details and reports. The NRF also reports that for every dollar of merchandise returned, merchants incur an expense of approximately 21 cents in return handling costs. When fraudulent returns are factored in, this cost increases, impacting the overall operational budget.

Increased Prices and Stricter Policies

To mitigate losses, eCommerce businesses might be forced to increase prices or implement stricter return policies. While this can help reduce fraud, it negatively impacts good shoppers — impacting brand reputation, customer satisfaction, and loyalty, as flexible return policies and competitive pricing are preferred.

Product and Inventory Headaches

Return fraud distorts inventory records and levels, leading to inaccuracies in stock data which can result in overstocking or understocking. Merchants spend considerable resources managing returns. A survey by Optoro, a technology firm focused on returns optimization, found that processing a single return can cost double the amount for shipping, including labor, inventory handling, and freight. On top of that, it’s estimated that a significant portion of returned merchandise cannot be resold at full value. A study by Appriss Retail found that in certain retail sectors, up to 10% of returned merchandise is not in a condition to be resold at the original price, affecting the overall value of inventory.

These challenges underscore the need for eCommerce businesses to adopt robust fraud prevention strategies. Measures such as implementing time limits on returns, requiring IDs, thorough record-keeping, training employees to spot fraud, using fraud protection software, and segmenting products based on value can be effective in mitigating return fraud. Additionally, technology plays a crucial role in preventing return fraud, with AI-powered software capable of identifying patterns indicative of fraudulent activity.