In the dynamic world of eCommerce, every transaction holds the promise of revenue growth. Lurking within this potential, however, lies an often-overlooked challenge that can significantly impact your bottom line — Address Verification System (AVS) mismatches.

Outdated fraud prevention methods rely too heavily on AVS and CVV verification to approve orders. Consider the following stats on gateway filters:

- 3.6% of all eCommerce shoppers put in the wrong billing address when they check out. Standard fraud-detection filters will flag these orders with an “AVS N” error notification and decline the transaction — even though 91.9% of those orders are from legitimate customers.

- 6.7% of all eCommerce shoppers enter a billing address that’s only partially correct (leading to the error notification “AVS A,Z”). A full 98.1% of those orders are legitimate, but all of them will be denied by overzealous gateway filters.

- Similarly, 15% of all transactions do not have an exact CVV match. 98.7%of those orders are safe to ship, but you won’t ship any of them if your strict gateway filter declines them first.

By turning away good customers, your gateway filters could be forcing you to leave money on the table. Take a few minutes to check if you have those profit-killing settings for your filters turned on at your payment gateway. By switching them off, you can easily boost your order acceptance rate by more than 10%.

Understanding AVS Mismatches

It used to be that AVS was a crucial security tool that aimed to match the billing address provided by the customer with the one on file with the issuing bank. This verification process added a layer of fraud prevention, ensuring that the rightful cardholder was making the purchase. However, with AVS mismatches a common challenge, relying on outdated gateway filters for fraud prevention has become obsolete.

Instead, merchants need an effective fraud prevention solution that can overlook customer errors or typos that may lead to an AVS or CVV mismatch — and unintentionally turn away a legitimate customer. A modern, genuinely effective fraud detection system uses multiple layers of technology to analyze many data points from multiple sources and drastically reduces the need for manual review.

Look for fraud prevention solutions that can reliably identify when data mismatches are the result of honest customer errors. When typos are detected, your solution should send alerts to customers instead of declining their orders, allowing them to correct their information and complete their purchases. That means you don’t lose out on a sale every time someone makes a mistake while typing in their billing address.

The Revenue Dilemma & Impact on Profits

AVS mismatches are a double-edged sword. On one hand, they thwart potentially fraudulent transactions, safeguarding your business from financial loss. On the other, they risk blocking genuine orders, causing frustrated customers to abandon their purchase and tarnishing your reputation. Every declined order translates to lost revenue and a tarnished customer relationship.

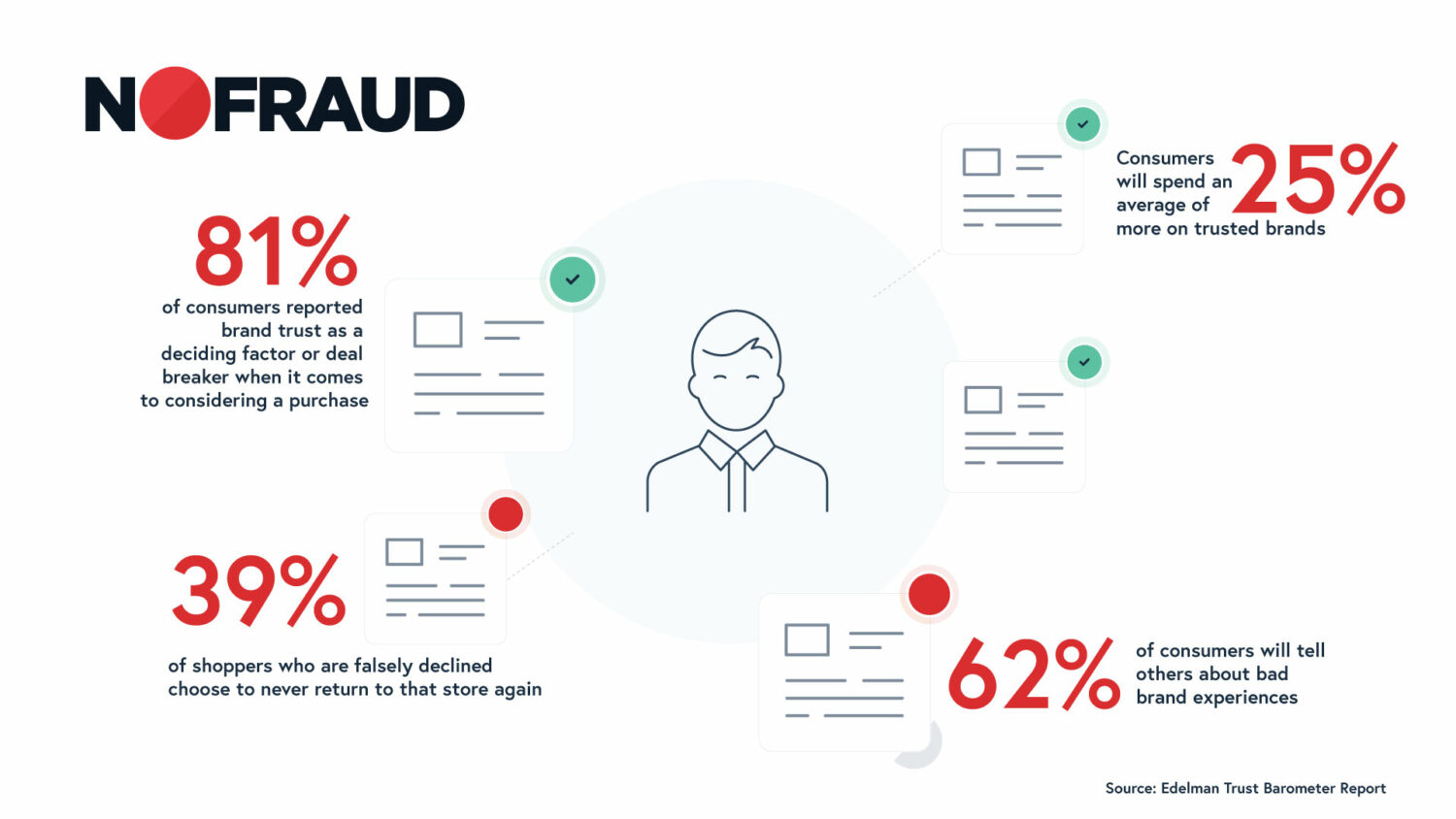

AVS mismatches contribute to a substantial hidden cost: lost revenue opportunities. Studies show that merchants lose up to 75 times more revenue to false declines than legitimate fraud. And when a legitimate transaction is declined due to a mismatch, as many as 39% of customers are likely to seek out competitors who offer a smoother purchasing experience.

This not only results in immediate revenue loss but also diminishes customer loyalty, leading to long-term revenue erosion.

Mitigating AVS Mismatch Fallout

Don’t rely on AVS alone: Implement a multi-layered approach that combines AVS with other fraud detection tools. This fortifies your defense against fraud while minimizing the risk of false positives. If you’re using a fraud prevention solution like NoFraud, platform capabilities will be able to reliably identify when data mismatches are the result of honest customer errors.

When typos are detected, NoFraud alerts customers instead of declining their orders, allowing them to correct their information and complete their purchases. That means you don’t lose out on a sale every time someone makes a mistake while typing in their billing address.

Make sure your solution also adapts to keep up with evolving fraud threats. By comparing data gathered from all NoFraud users, NoFraud’s algorithm is able to spot emerging fraud trends and better protect all the merchants who rely on it.

Give customers a chance to correct AVS mistakes: Proactively inform customers about the possibility of AVS mismatches and declined transactions. Provide clear instructions on how to proceed or correct their details in the event of a mismatch. This both demonstrates your commitment to their satisfaction and salvages potentially lost sales.

Adapt to new trends and patterns: Regularly monitor your transaction data for patterns related to AVS mismatches. Adapt your strategies based on insights gained to strike the right balance between fraud prevention and revenue optimization.

While AVS mismatches play a pivotal role in shielding your business from fraud, they also pose a formidable threat to your revenue potential. Striking the right equilibrium between stringent security measures and seamless customer experiences is essential for sustainable growth. By leveraging a combination of refined AVS settings, advanced fraud detection tools, proactive customer communication, and adaptable strategies, you can safeguard your eCommerce revenue, foster customer loyalty, and steer your business towards success in the ever-evolving eCommerce landscape.