When most think of fraud prevention, it’s a reactive strategy. That’s why the best eCommerce shops take a proactive approach to give themselves an advantage. Reactive fraud prevention focuses on responding to fraud only after it has occurred, while proactive fraud prevention is all about preventing fraud from happening in the first place.

Proactive fraud prevention and a great customer experience go hand-in-hand. By proactively protecting customers and your business, you’re ultimately building trust and loyalty — and setting your shop up for higher order values and more repeat business. Research shows that 68% of consumers say they spend more on brands they trust, and on average they spend up to 25% more.

So, how can merchants lean into this to boost revenue? It’s all about building trust and that’s where fraud prevention comes into play. Here’s a breakdown of how to leverage fraud prevention to effectively support aggressive revenue goals.

Build Customer Trust to Increase Spend

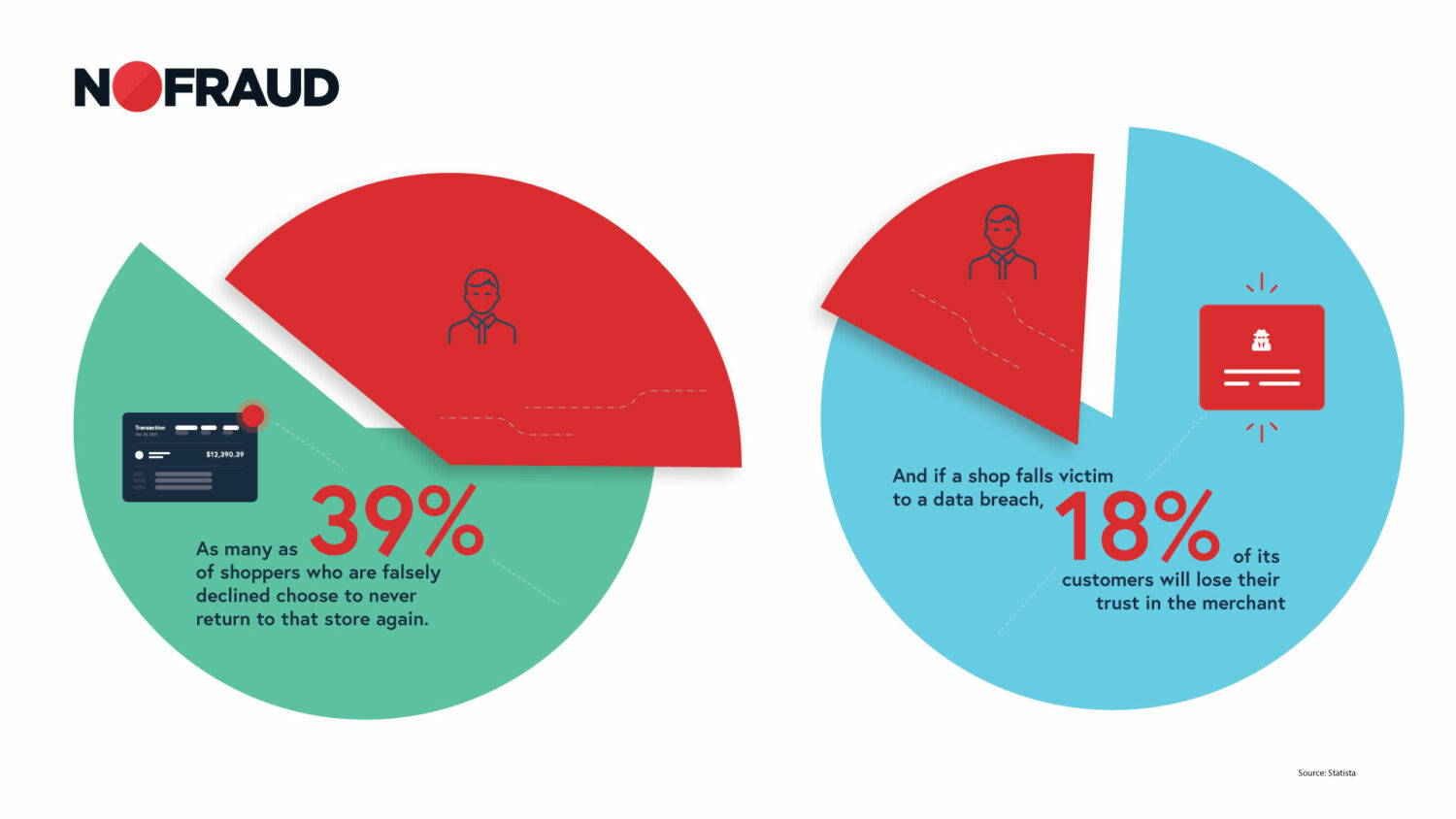

When customers feel confident that their financial information is secure and protected, they are more likely to make purchases and spend more money with a merchant. As many as 39% of shoppers who are falsely declined choose to never return to that store again. And if a shop falls victim to a data breach, 18% of its customers will lose their trust in the merchant.

Fraud prevention measures can help customers feel more secure when making purchases from a shop. To gain the trust of customers, implement best practices like the following:

- Clear and transparent communication: Avoid jargon, and thoroughly explain your return and refund policies in simple terms. Use descriptive words and pictures to set expectations on products.

- Data protection: Use a secure payment gateway, and encrypt all transaction data across all communication lines, including website and email.

- Customer identity verification: Verify customer information to prevent unauthorized use of customer data and access to customer accounts.

It’s important to find the right balance between setting up blockers against fraud and maintaining a frictionless customer experience. The idea is to make it easy for customers to purchase (and repeat), but not for fraudsters to capitalize on vulnerabilities and put customers at risk.

Better Prepare to Expand Market Opportunities

When merchants have strong fraud prevention measures in place, they can expand market opportunities and their customer base with less risk. By understanding the risk profile of their business and markets, eCommerce shops can implement the right fraud prevention mechanisms like fraud detection software, identity verification processes, and transaction monitoring tools, to mitigate the risk of fraud.

A fraud risk profile helps organizations identify and assess the likelihood and potential impact of fraudulent activities. This involves analyzing factors like the type of products or services offered, the transaction volume, the geographical locations of customers, and the historical data of fraudulent activities.

Side note: Some industries have specific regulations or requirements around fraud prevention, e.g., healthcare or financial services. Investing in strong fraud prevention measures can help businesses demonstrate compliance with these regulations and expand their market opportunities within these sectors.

Businesses that demonstrate a commitment to fraud prevention can attract customers from regions or markets where fraud is a common concern. Surprisingly, nearly two-thirds of online shoppers reported that they do not trust brands to prevent fraud. This is a massive opportunity for eCommerce brands to build trust and gain loyalty.

Create Seamless Checkout Experiences to Improve Conversion Rates

Research shows that 9% of cart abandoners leave if they don’t see enough payment options and 16% leave if they can’t see their total order cost upfront. Effective fraud prevention practices create very clear and transparent checkout experiences with multiple secure payment options. When customers and merchants are aligned on transaction expectations — offering enough of the right information as early as possible in the buying journey — it sets the business up for success.

By having verification, secure payment and checkout, transparent policies that are clearly listed and other fraud prevention best practices, it signals to customers that the brand takes their business seriously. It shifts from being purely transactional, i.e. “we want your money” to a relationship-building exercise, i.e., “we are proud of our products and want to give you enough information to make the right decision for you.” This focus highlights the customer and shows that the business is taking their experience into consideration, demonstrating the business wants and expects to delight the customer.

Use Valuable Human Hours to Power Business Growth

On average, a retailer will spend 1.8 hours resolving each chargeback. If you process 5,000 orders per day at a 0.5% chargeback rate, that’s 25 chargebacks and 45 hours of work for your team. At this rate, your team needs 684 full days to resolve a year’s worth of chargebacks. Imagine what you could use your employees’ time for instead!

With a full-service fraud prevention solution, the manual labor burden of chargebacks is alleviated, so you can get back to focusing on driving revenue and not reactively fighting fraud. A solution like NoFraud can help mitigate 100% of the risk: If you get a fraud chargeback, we will pay you back!

Fraud Prevention: It’s All About Earning Customers’ Trust

When merchants prioritize trust over risk scores, they can reduce chargebacks, false positives, friction, lost sales, and damage to their brands. Apart from strengthening fraud prevention, improving customer experiences is the most necessary part of any eCommerce strategy. Having a trust score that continually learns from each customer to reduce transaction delays further and improve accuracy using machine learning has proven most effective in thwarting fraud. Trust is the best revenue accelerator there is, and now is the time to enhance eCommerce with a more precise approach to completing sales.