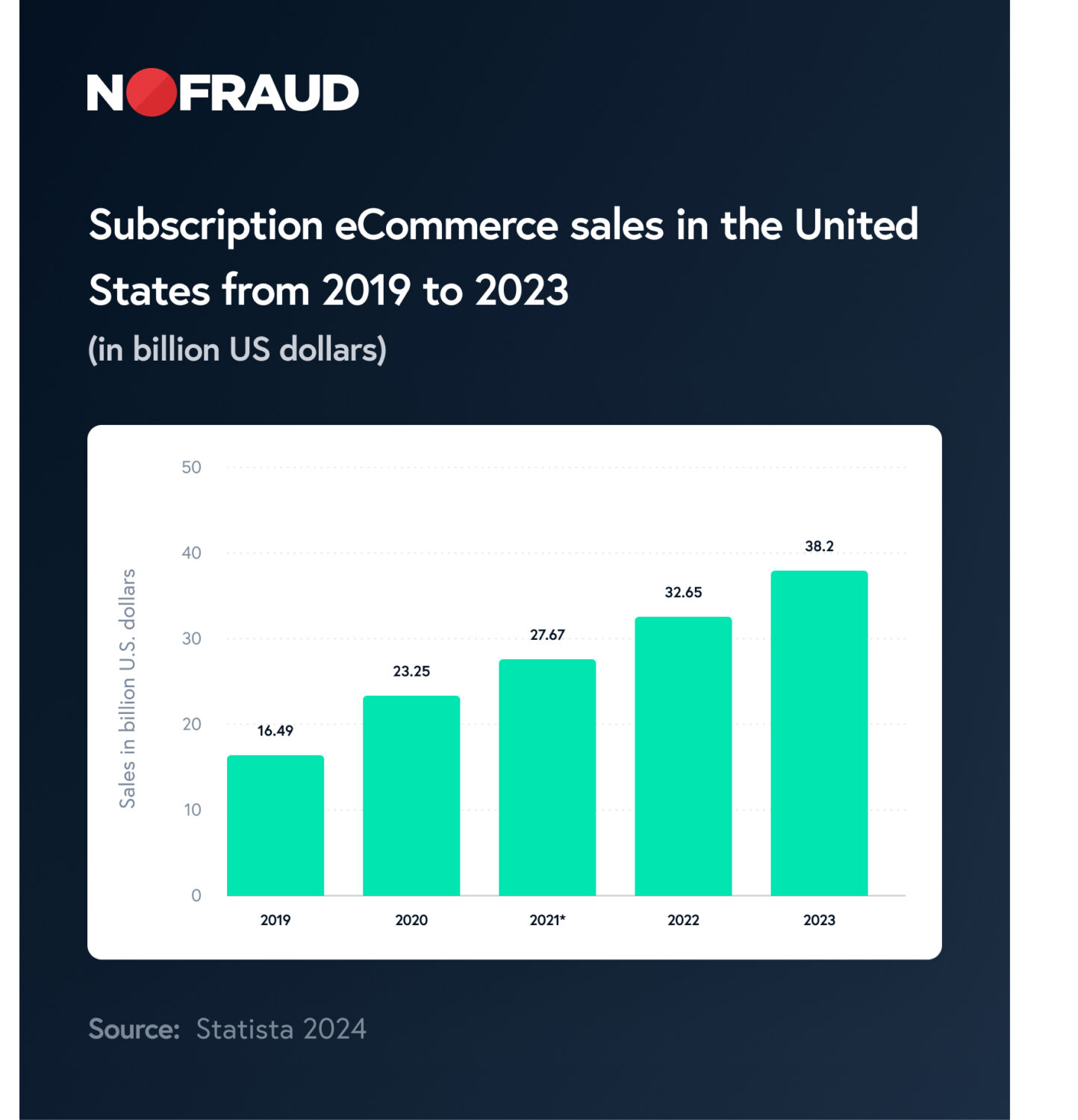

Shoppers love subscriptions, and for merchants, automated subscription payments are an eCommerce dream. Once a customer is acquired, they’re much more likely to buy repeatedly when subscribed. With customer acquisition costing up to five times more than retention plays, just a 5% boost in retention can yield a 25-95% increase in profits. In the United States, eCommerce subscription sales jumped 132% between 2019 and 2023. Subscriptions offer shoppers an ideal customer experience that provides set-it-and-forget-it convenience for essential goods, with the flexibility to cancel at any time or skip shipments as needed.

As subscription sales have grown, so has subscription fraud. Around 60% of subscription-based businesses have noticed a surge in online payment fraud over the past 12 months, with 56% of these merchants encountering new and emerging threats.