Chargebacks hurt businesses. Whether initiated by customers dissatisfied with their purchase and the return process or fraudsters looking to game the system and score free goods for resale, chargebacks are bad for business. The shoppers you want — who end up leaving your shop with a bad taste in their mouth — are likely never to return and won’t be good referral sources for your business. As for cybercriminals, they will think they have found a loophole that they can continue to exploit for financial gain.

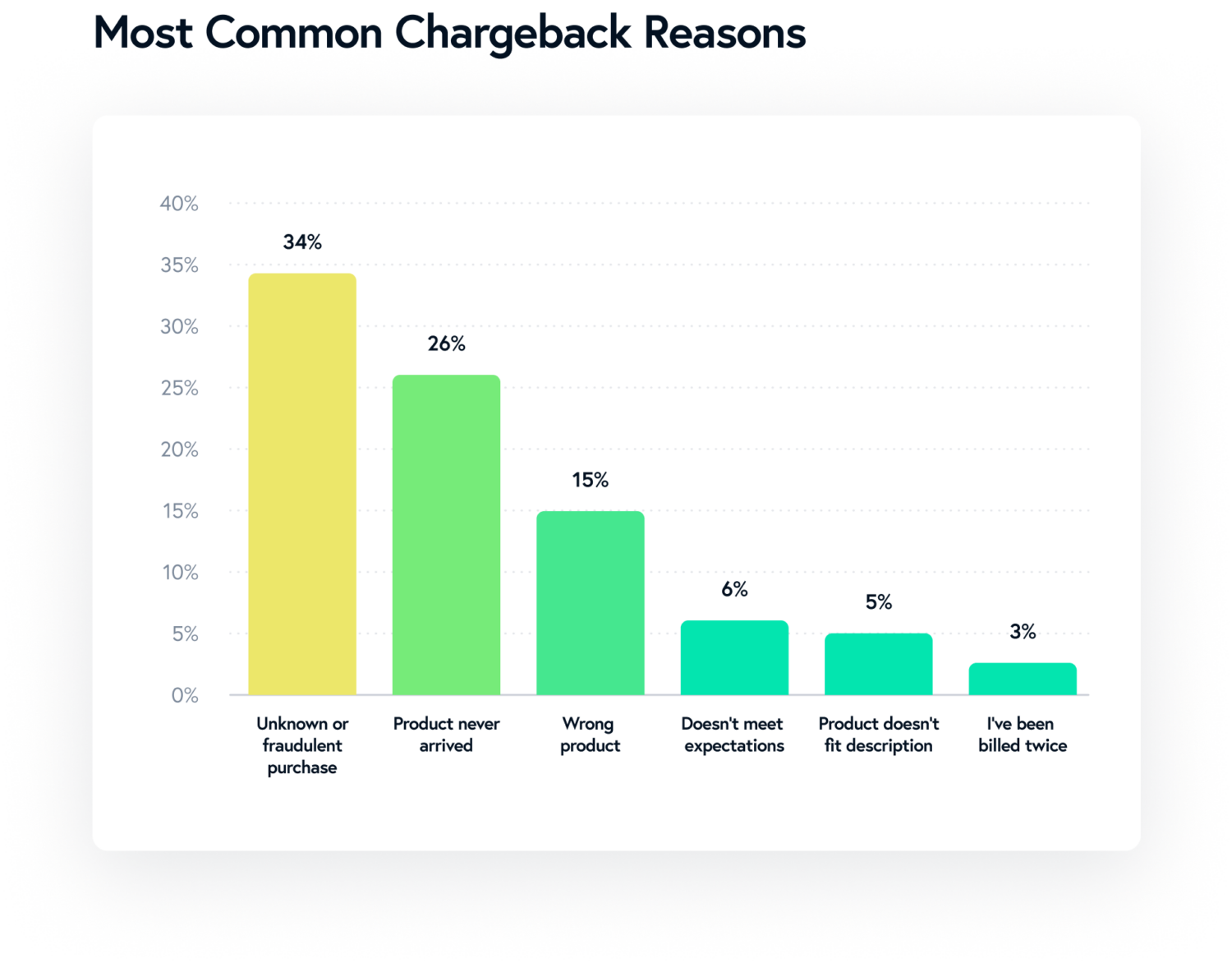

Regardless of how chargebacks happen, it takes retailers an average of 1.8 hours per dispute to resolve, and fees levied by the credit card provider or bank can reach up to $100 per transaction. According to ClearlyPayments, 34% of chargebacks are deemed fraudulent.

To get ahead of chargebacks and prevent them from happening in the first place, read 5 Ways to Prevent Chargebacks. If you’re noticing a rise in chargebacks, keep reading. In this article, we share five signs that the chargebacks you’re getting hit with are likely fraudulent. If you notice any of these happening, it’s worthwhile to run deeper analyses to understand how many fraudsters are initiating chargebacks through the following methods so you can take action and prevent chargeback fraud.