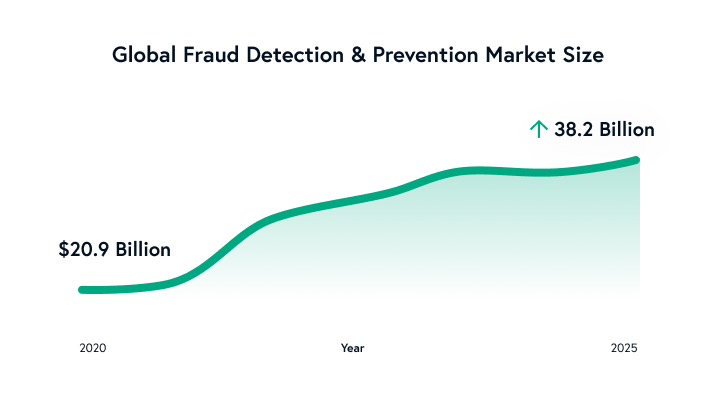

Global payment fraud is on the rise and is predicted to cost merchants $40.62 billion in losses by 2027. It is no wonder the global fraud detection and prevention (FDP) market size is expected to grow from $20.9 billion in 2020 to $38.2 billion by 2025 (Markets and Markets, 2020).

This ebook will explore what merchants should expect from their full-service fraud prevention solution.

The ever-increasing rise in popularity of eCommerce enjoyed a sudden acceleration by the recent pandemic that forced many consumers to divert their spending from in-person to online. Whether or not they were ready for it, consumers and businesses alike were forced to shift their activities to a virtual arena hastily. Many consumers began transacting via new digital payments for the first time. The booming eCommerce market remains strong even as the economy reopened and a post-pandemic marketplace emerged.

The increase in eCommerce activity and the widespread use of digital payments have created even more opportunities for fraud. Retailers have come a long way from “Pay and Chase” fraud prevention, but so have fraudsters. As added security to in-person credit card use becomes increasingly sophisticated, criminals are turning their attention online and constantly inventing new ways to commit card-not-present (CNP) fraud, account takeovers, identity theft, and bot attacks—to name a few.

Enormous strides in technological advancements, such as smart bots that can optimize search for Google, are being used against eCommerce businesses by fraudsters seeking a payday. As potential payoffs increase and the cost of cyber attacks decreases, fraudsters are becoming more incentivized. The lack of aggressive prosecution for online payment fraud further emboldens fraudsters. According to LexisNexis, Successful monthly fraud attempts increased by 45% for mid-to-large retailers and 27% for smaller retailers.