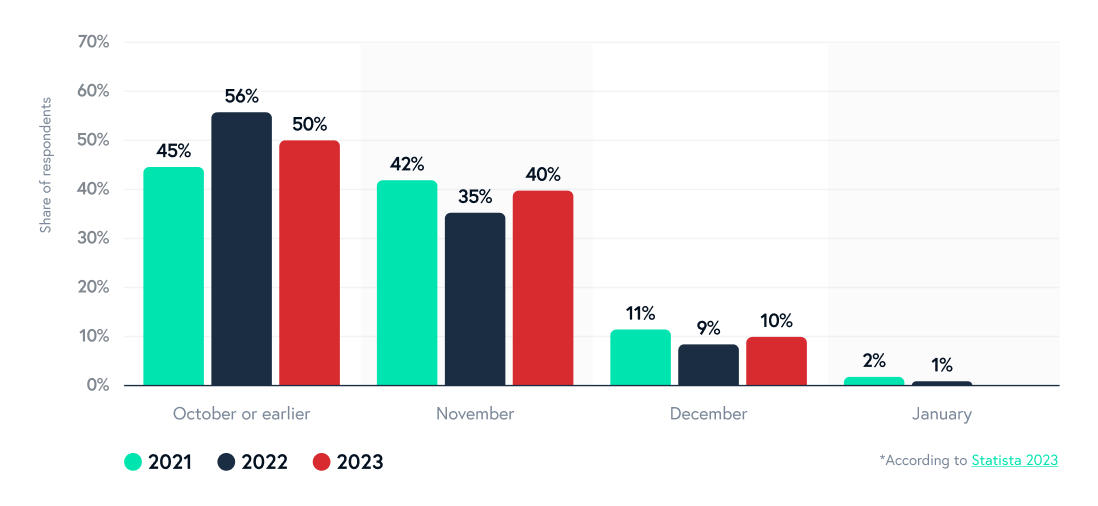

A Longer Holiday Season = Extended Fraud Risk

McKinsey partner, Tamara Charm, says that this year’s shoppers are showing different shopping behaviors. Most noticeable is a general down-trade mood amongst consumers. Although consumers may be in decent financial shape, there is an air of pessimism and shoppers are downtrading because they’re worried about what might come next.

Charm also says, “consumers — rather than rushing to the shelves, to their phones, or to websites to buy something before everything runs out — are instead lengthening the holiday season. Their number-one concern is, ‘When can I get the items that I want at the best price possible?’”

Be sure to have a seamless checkout experience for shoppers when they are ready to buy. Fraud prevention measures that hinder a smooth customer journey will result in abandoned carts and lost revenue. Use fraud protection solutions that reduce false declines and remove friction during checkout.

Anticipate an Increase in Friendly Fraud

A spike in chargebacks will inevitably follow a spike in sales. Even when you are properly vetting your customers, legitimate cardholders often submit fraudulent chargeback claims. This is known as friendly fraud or chargeback fraud.

This type of fraud is difficult to detect preventatively but can often be won via proper chargeback representment. Keeping good records and encouraging customers to reach out directly to your business if they are unsatisfied with their purchase will help mitigate friendly fraud.

The Soft Underbelly of eCommerce

Businesses that rely on manually reviewing orders for fraud will be more vulnerable during peak seasons when teams are spread thin, and fulfillment centers are flooded with orders. Fraudsters often exploit this vulnerability and place their orders in the early morning and add expedited shipping in hopes that the fraud team will be too overwhelmed with getting orders shipped and will be lenient with fraud review. Look out for suspicious orders placed at odd hours to stay protected against fraud opportunists.