Identity theft is a rapidly growing concern in the United States and globally, affecting both merchants and shoppers. More than one-third of chargebacks are reported as fraudulent. The market for identity theft protection services is expected to reach $34.7 billion by 2032 (according to Market.us), up from last year’s $12.5 billion. Identity theft continues to worsen, as evidenced by the following findings:

- In 2023, the Federal Trade Commission (FTC) received 5.7 million total fraud and identity theft reports, with 1.4 million being identity theft cases.

- Identity theft reports have increased 68.3% since 2019.

- 24 of the 100 largest U.S. metro areas saw identity theft reports double per 100,000 residents between 2019 and 2023.

- Every U.S. state has experienced an increase of more than 11% in identity theft reports per 100,000 residents since 2019.

- Credit card fraud is the most common type of identity theft, but government documents or benefits fraud is rising.

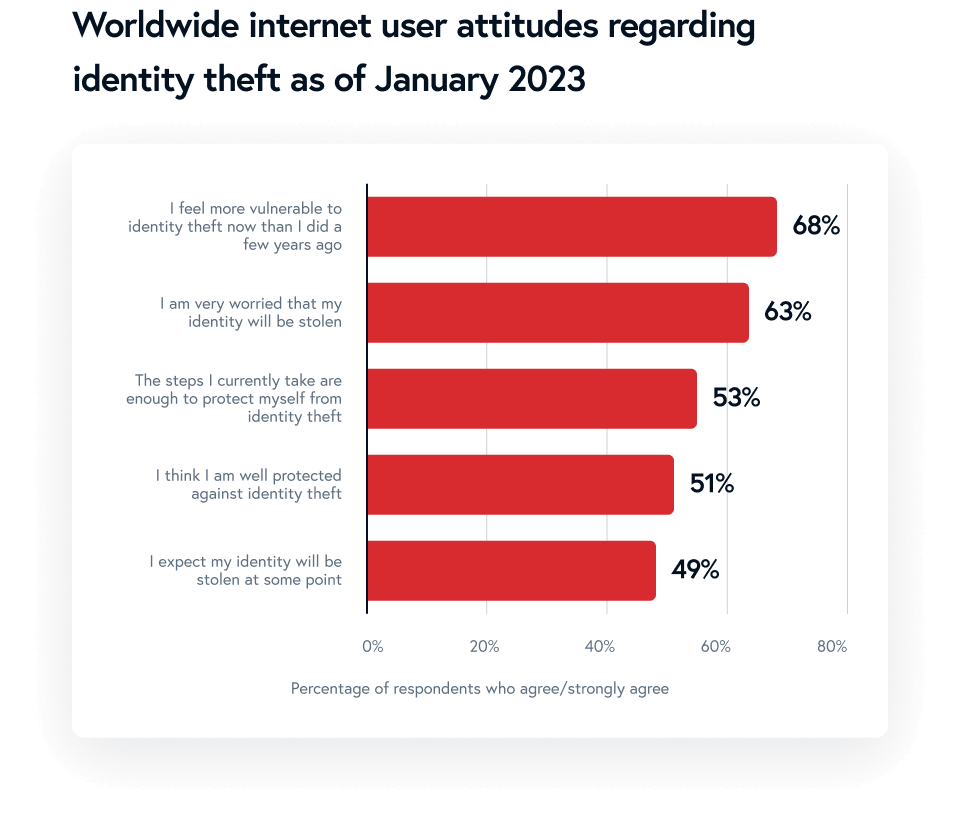

As theft methods become more sophisticated, individuals are encouraged to take proactive measures to safeguard their personal information, including using antivirus protection software, password managers, identity theft protection services, and Virtual Private Networks (VPNs) to mitigate the risk of falling victim to identity theft. While nearly half of consumers feel they’ve taken sufficient steps to prevent identity theft, close to 70% still feel more vulnerable to an identity theft attack than a few years ago.