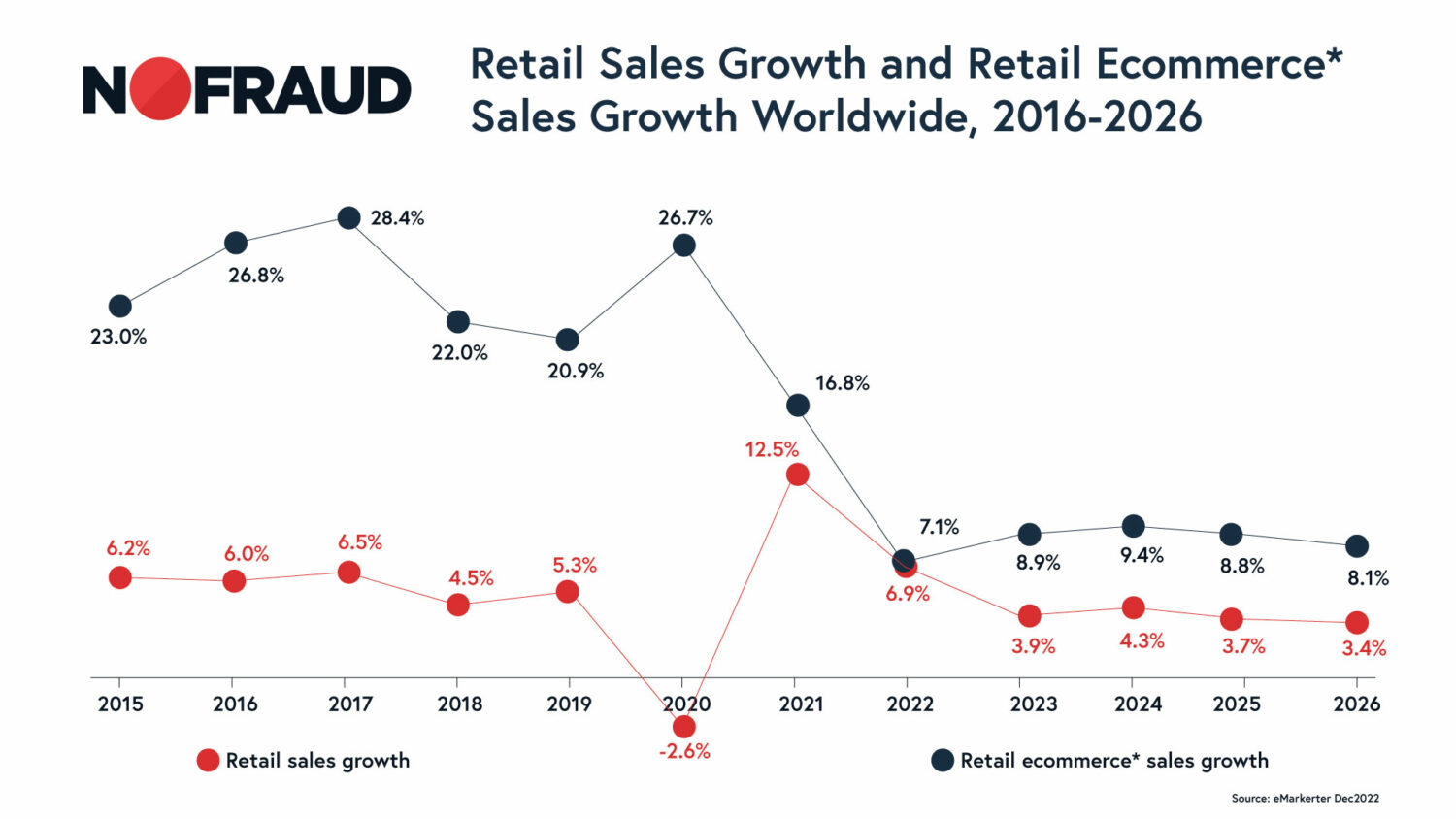

Even before the pandemic, online sales were seeing a massive boom. Forecasters predicted continued momentum moving beyond the pandemic, but 2021 and 2022 saw substantially smaller growth as numbers leveled out. Still, the gap between eCommerce sales growth and retail sales growth has narrowed, with eCommerce expected to grow 8.9% this year compared to 3.9% for total retail sales.

The growing demand for online shopping presents its own challenges for which brick-and-mortar shops don’t have to contend. As Drip CMO, Emil Kristensen, says, “It’s incredibly frustrating to successfully move a shopper through the sales funnel and create offers that are enticing enough to pique their interest, only to inevitably lose them at the point of purchase.”

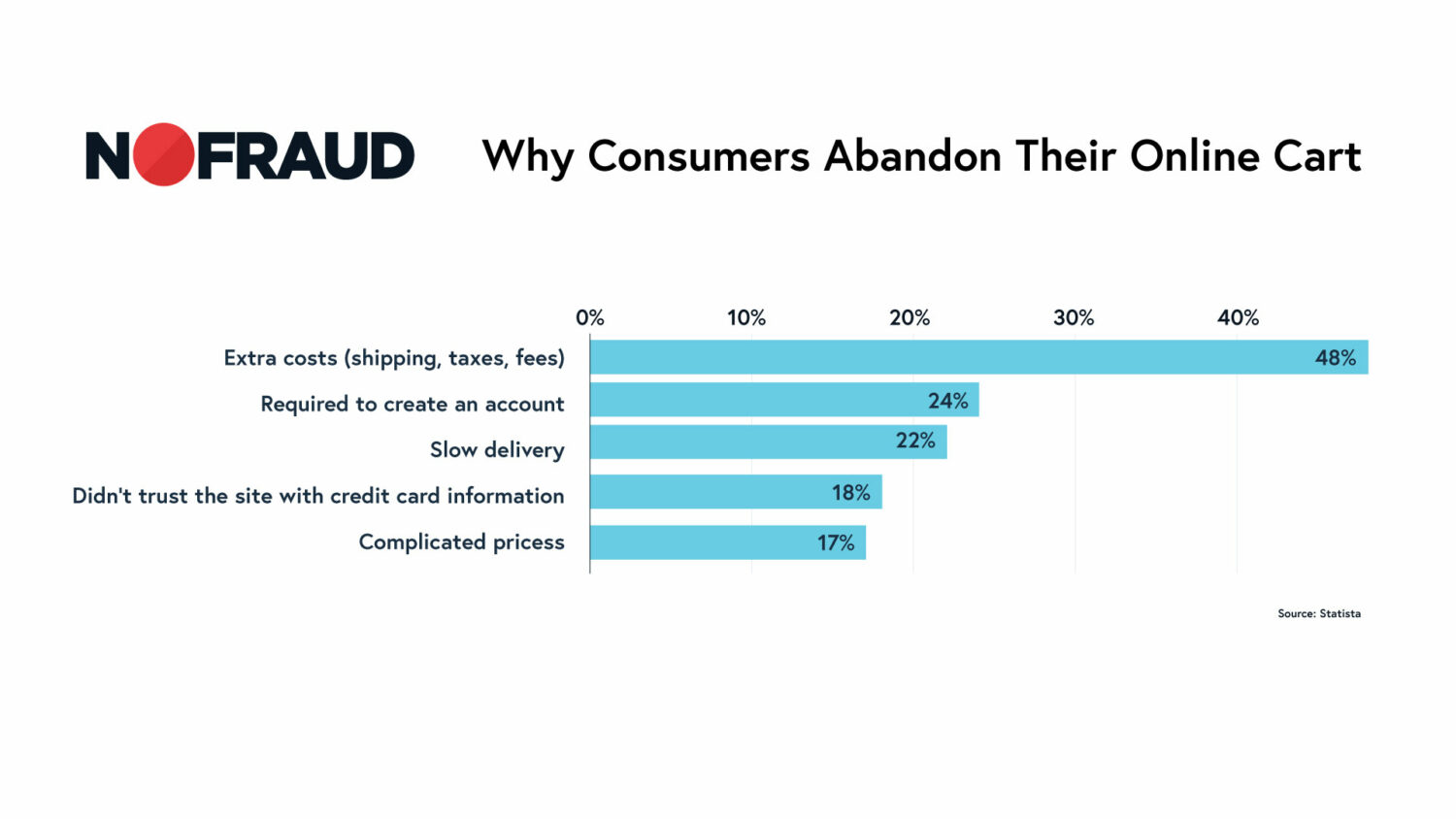

While brick-and-mortars might have window shoppers who can enter a shop and leave just as quickly without saying a word to any retail associates, eCommerce has the benefit of useful shopper data that can help drive conversions. The latest research attributes the number one reason for shopping cart abandonment to window shoppers who were just browsing or not ready to buy; most of whom abandon before initiating the checkout flow. Segmenting this group out, the top five reasons customers abandon carts are because of unexpected costs (shipping, taxes, fees), an account creation or login requirement, slow delivery, not trusting the shop to properly handle payment information, and an overcomplicated checkout process.

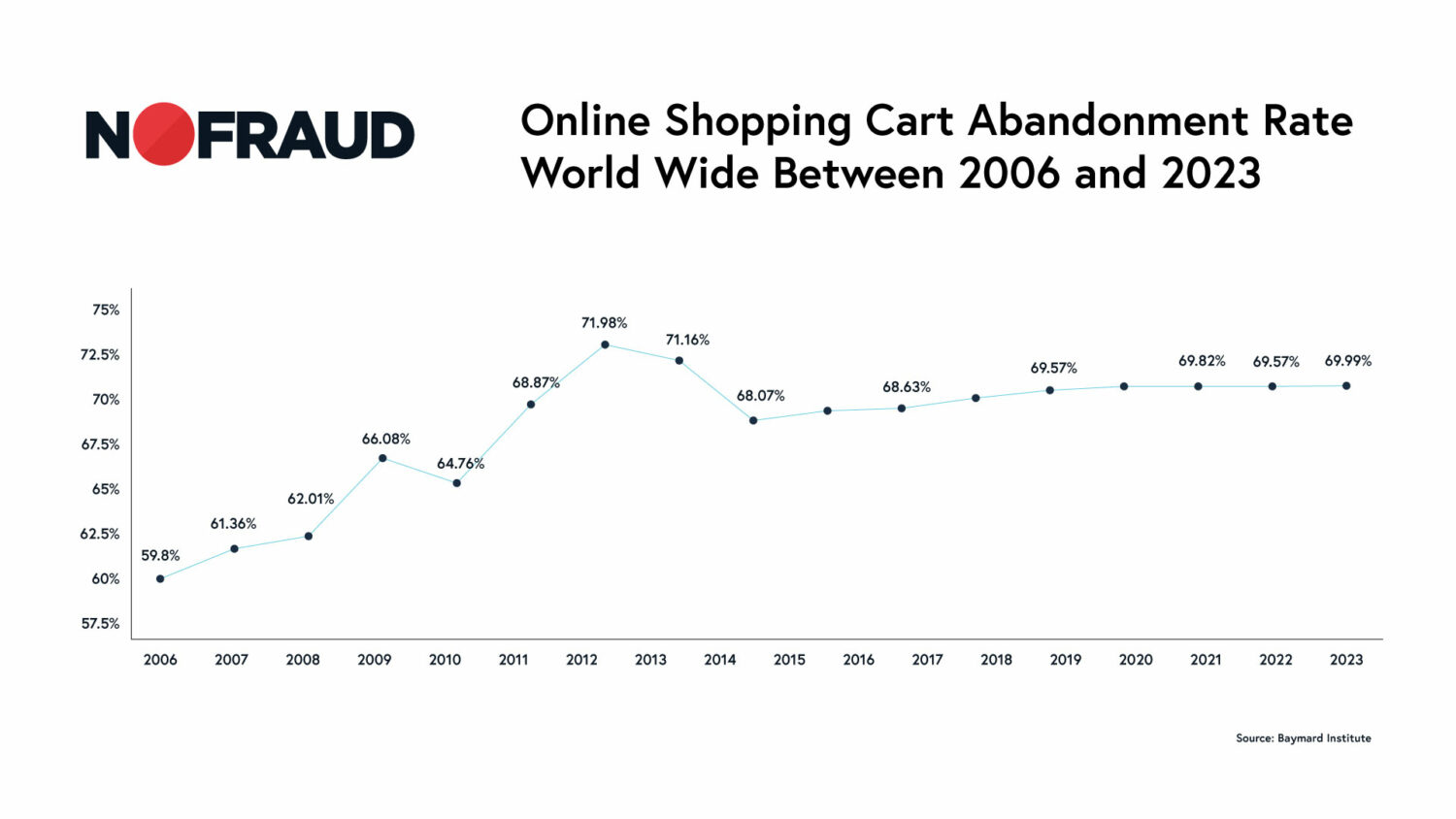

Shopping cart abandonment has been steadily rising with the current average — across all industries — sitting at 69.99%. The good news is that there are proven ways to minimize cart abandonment; here are four to try.

Solutions to Stop Cart Abandonment

1. Optimize for Mobile Devices

Mobile shopping has seen significant growth, but it also tends to have higher cart abandonment rates compared to desktop. Mobile drives 68% of eCommerce traffic, and it accounts for at least half of purchases, yet has an 86% cart abandonment rate — which is 10-20% higher than desktop rates.

The vast majority of shoppers (84%) have had bad mobile experiences and those experiences are impactful enough to drive shoppers to your competitors. Research shows that 40% of consumers will spend their money at a competitor’s shop after a bad mobile experience.

With the increasing prevalence of mobile shopping, it is crucial to have a mobile-responsive website to keep more customer’s shopping with you. Ensure your website is optimized for smaller screens, fast loading, and easy navigation, providing a seamless mobile shopping experience.

2. Simplify the Checkout Process

Complicated checkouts discourage customers from completing purchases. Experts estimate that by effectively optimizing the checkout experience, merchants can increase conversions by 35%. Looking at the combined total of eCommerce sales between the US and Europe — $738 billion — and applying a 35% increase in conversion rates, there is potential to recover $260 billion worth of lost orders exclusively with improved checkout flows.

Make sure your checkout process is streamlined and user-friendly. Avoid asking for unnecessary information, and keep the number of steps to a minimum. Baymard’s extensive research on cart and checkout usability has found that among the top 214 top-grossing eCommerce sites across the US and Europe, the average site has 39 unique improvements that could be made to checkout flow.

Here are some tips for simplifying checkout to improve usability and flow:

- Use real-time declines: Most fraud prevention solutions screen orders post-gateway and do not provide merchants or consumers with an opportunity to redeem a rejected order. Pre-gateway fraud prevention screening helps to ensure maximum approvals. Working in sync with a dynamic checkout, real-time declines prompt customers to fix typos or incorrect information in the moment, when they are most motivated to complete the checkout, to decrease false declines.

- Create dynamic fields: The average form has 3.8 more fields than necessary. Each additional unnecessary field increases friction and reduces the likelihood of checkout completion. Limit the number of form fields and set up dynamic fields to approve more high-risk, yet legitimate, orders. Orders displaying elevated risk factors will be asked for more information. Additional fields will dynamically appear to allow customers to remove suspicions of fraud from their orders. This provides merchants with effective protection from fraud, while simultaneously ensuring every possibility of legitimizing the riskiest orders.

- Implement guest checkout: 24% of online shoppers abandon their cart when they’re required to create an account. While you can ask online shoppers if they’d like to create an account, it shouldn’t be required. This is an added blocker that can discourage them from completing their purchase, leaving your online store to look elsewhere for what they need. Some consumers prefer to checkout as a guest and don’t want to go through the time and hassle of creating a username and password.

3. Offer Multiple Payment Options

Imagine getting excited because you’ve scored some great products after spending 30 minutes shopping on a site only to find at checkout that your preferred payment method isn’t accepted by the merchant. A problem that frustrates customers so much that almost one in ten cart abandoners leave for this exact reason.

Provide a variety of payment methods to cater to different customer preferences, and make it clear upfront which options customers have. Include popular credit card options, payment via PayPal, and digital wallets like Apple Pay or Google Pay. The more choices you offer, the more likely customers will find a method they are comfortable using.

4. Display Trust Signals

Build trust with your customers by displaying trust signals throughout the checkout process. Every element necessary to complete a purchase in the checkout experience should be immediately obvious to the shopper. As many as 17% of cart abandoners leave because they don’t trust the site with their credit card information.

Be sure to include security badges, SSL certificates, customer testimonials, and reviews to help social proof your brand and build trust with customers.

Additional tips for communicating trust to customers:

- Make privacy policies clear: Be explicit if your site conducts secure transactions to help alleviate privacy and data safety concerns to boost customer confidence in your website.

- Add a progress tracker: Progress trackers help customers understand the steps needed to complete checkout. Without it, customers may feel they’ve fallen into an abyss of filling out page after without an end in sight. Seventeen percent of abandoners leave because the checkout process is too long. Adding a progress tracker helps keep more customers on track to a successful checkout because they know how many steps are needed before the goods are officially theirs.

- Proactively share all costs: Almost half of all cart abandoners leave because of unexpected costs. As an easy fix, make pricing and any added fees appear alongside checkout so customers get a better sense of payment expectations when it comes time to checkout.

Reducing Cart Abandonment With Effective Fraud Prevention

With cart abandonment rates steadily rising over the past decade, reducing cart abandonment is a cross-team effort involving product, marketing, fraud teams, and beyond.

For fraud teams, it’s all about putting trusted customers on the fast track and speedily, yet thoroughly vetting risky customers so legitimate sales aren’t lost. There are plenty of reasons customers can be flagged as high risk, but still remain legitimate shoppers. It’s the merchant’s responsibility to help customers legitimize risky orders with fraud prevention best practices.