Executive Summary

Proactive review is the practice of identifying and addressing fraud risk before it converts into disputes, refunds, or chargebacks. Unlike reactive approaches that respond after losses occur, proactive review focuses on early signals that indicate elevated risk across checkout, fulfillment, and post-purchase workflows.

This refresh explains what proactive review means in modern ecommerce, how it differs from traditional manual review, and how merchants can apply it without slowing down growth or increasing false declines.

It is most effective when paired with strong automation and post-purchase intelligence, especially in environments where friendly fraud, refund abuse, and item not received (INR) are driving losses.

What Is Proactive Review

It is a risk-based approach to fraud prevention that evaluates orders, accounts, or events before they result in financial loss. Rather than waiting for a chargeback or refund request, this type of review uses signals such as identity inconsistencies, behavioral anomalies, delivery risk, and historical outcomes to intervene early.

This approach contrasts with reactive review, where action is taken only after a dispute, refund, or complaint occurs.

For foundational context, see ecommerce fraud and fraud detection.

Proactive Review vs Traditional Manual Review

Manual review is often reactive, labor-intensive, and narrowly focused on checkout decisions. Proactive review expands the scope and timing of review while reducing unnecessary human effort.

Key differences include:

- Traditional manual review focuses on individual transactions at checkout

- Reviewing proactively evaluates patterns across orders, accounts, and behaviors

- Manual review is often binary approve-or-decline

- Reviewing transactions proactively enables targeted actions such as step-up verification, delayed fulfillment, or post-purchase monitoring

Research consistently shows that manual review can become one of the largest cost centers in fraud operations. For analysis, see manual review as a major fraud budget driver.

Why Proactive Review Matters More Than Ever

Several trends have increased the value of reviewing orders proactively:

- Fraud shifting from checkout to post-purchase stages

- Growth in refund, return, and delivery-related abuse

- Increased customer expectations for fast, low-friction checkout

- Rising cost of disputes and operational overhead

Merchants relying solely on checkout screening often miss early warning signs that appear during account creation, address changes, or delivery updates.

Common Signals Used in Proactive Review

Effective proactive review does not rely on a single signal. It combines multiple indicators, including:

- identity and account consistency

- device and behavioral patterns

- order velocity and value changes

- delivery risk signals such as reroute requests

- historical outcomes tied to the customer or device

Delivery manipulation patterns such as reroute fraud and fake delivery claims frequently surface before disputes and can be addressed proactively.

Where Proactive Review Fits in the Customer Lifecycle

This type of review can be applied at multiple points:

Pre-purchase

Reviewing high-risk orders before fulfillment helps prevent unauthorized transactions and reduces downstream disputes.

Post-purchase but pre-fulfillment

Address changes, expedited shipping requests, or payment method updates after checkout are high-signal events that benefit from reviewing transactions proactively.

Post-fulfillment

Monitoring early claims, returns, or refund requests allows merchants to intervene before escalation to disputes or chargebacks.

This lifecycle approach aligns closely with modern post-purchase fraud prevention strategies and the unified direction described in the NoFraud + Yofi platform.

Proactive Review and Chargeback Reduction

Chargebacks are rarely random. They are often the final outcome of unresolved issues that could have been addressed earlier.

By identifying risky patterns early, proactive review helps merchants:

- reduce unauthorized transactions

- prevent repeat abuse

- resolve issues before customers contact banks

- lower overall dispute ratios

For foundational chargeback context, see Chargebacks 101 and the true cost of chargebacks.

How Merchants Implement Proactive Review Effectively

Focus review on risk, not volume

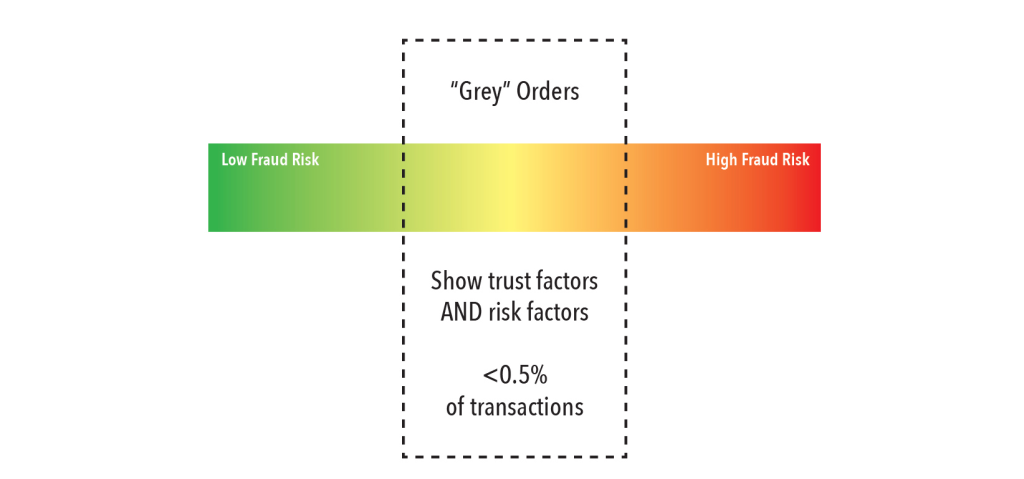

Reviewing everything creates bottlenecks and false positives. Proactive review targets high-risk scenarios rather than applying blanket scrutiny.

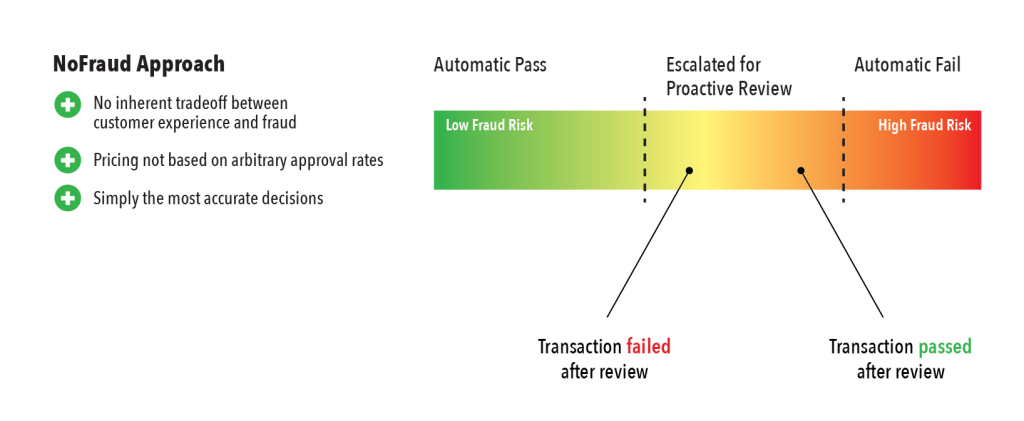

Automate first, escalate selectively

Automation should handle low-risk decisions. Human review should be reserved for ambiguous or high-impact cases where judgment adds value.

Use outcomes to refine review criteria

Review effectiveness improves when outcomes like disputes, refunds, and delivery failures are fed back into decision logic.

Coordinate fraud, CX, and operations teams

This type of review often requires coordination across teams to ensure interventions are consistent and customer-friendly.

Common Mistakes in Proactive Review

Merchants often struggle when they:

- rely on static rules that fail to adapt

- apply review too broadly, increasing friction

- fail to connect review decisions to outcomes

- treat review as purely a fraud team function

Avoiding these pitfalls is critical to realizing the benefits of review without harming conversion or customer experience.

Frequently Asked Questions

What is proactive review in ecommerce fraud prevention?

It is the practice of identifying and addressing fraud risk before it leads to losses such as refunds, disputes, or chargebacks.

Is proactive review the same as manual review?

No. It is broader and more strategic. It uses automation, pattern analysis, and targeted human intervention rather than reviewing every order manually.

Does proactive review slow down checkout?

When implemented correctly, it minimizes friction by focusing on high-risk cases while allowing low-risk customers to move through quickly.

How does proactive review reduce chargebacks?

By identifying risky behavior early and resolving issues before escalation, review prevents many disputes from ever reaching banks.

Summary

Reviewing transactions proactively represents a shift from reactive fraud response to preventative risk management. Merchants that adopt this type of review stop fraud earlier, reduce operational costs, and protect customer experience by intervening only where risk justifies it.

As fraud continues to move beyond checkout, proactive review is becoming a core capability for ecommerce teams focused on sustainable growth.